Airplanes and helicopters. Boeing reports third quarter results

Company still expects to deliver 70-80 B-787 and now 375-400 B-737 airplanes

The Boeing Company recorded third quarter revenue of $18.1 billion, GAAP loss per share of ($2.70) and core loss per share (non-GAAP) of ($3.26). Third quarter results were impacted by unfavorable defense performance and lower 737 deliveries. Boeing reported operating cash flow of $0.0 billion and free cash flow of ($0.3) billion (non-GAAP).

Operating cash flow was $0.0 billion in the quarter reflecting less favorable receipt timing, including the absence of a prior year tax refund.

Cash and investments in marketable securities totaled $13.4 billion, compared to $13.8 billion at the beginning of the quarter. The company has access to credit facilities of $10.0 billion, which remain undrawn.

Total company backlog at quarter end was $469 billion.

Segment Results

Commercial Airplanes

Third quarter revenue increased to $7.9 billion driven by higher 787 deliveries. Operating margin of (8.6) percent also reflects lower 737 deliveries as well as abnormal costs and period expenses, including research and development.

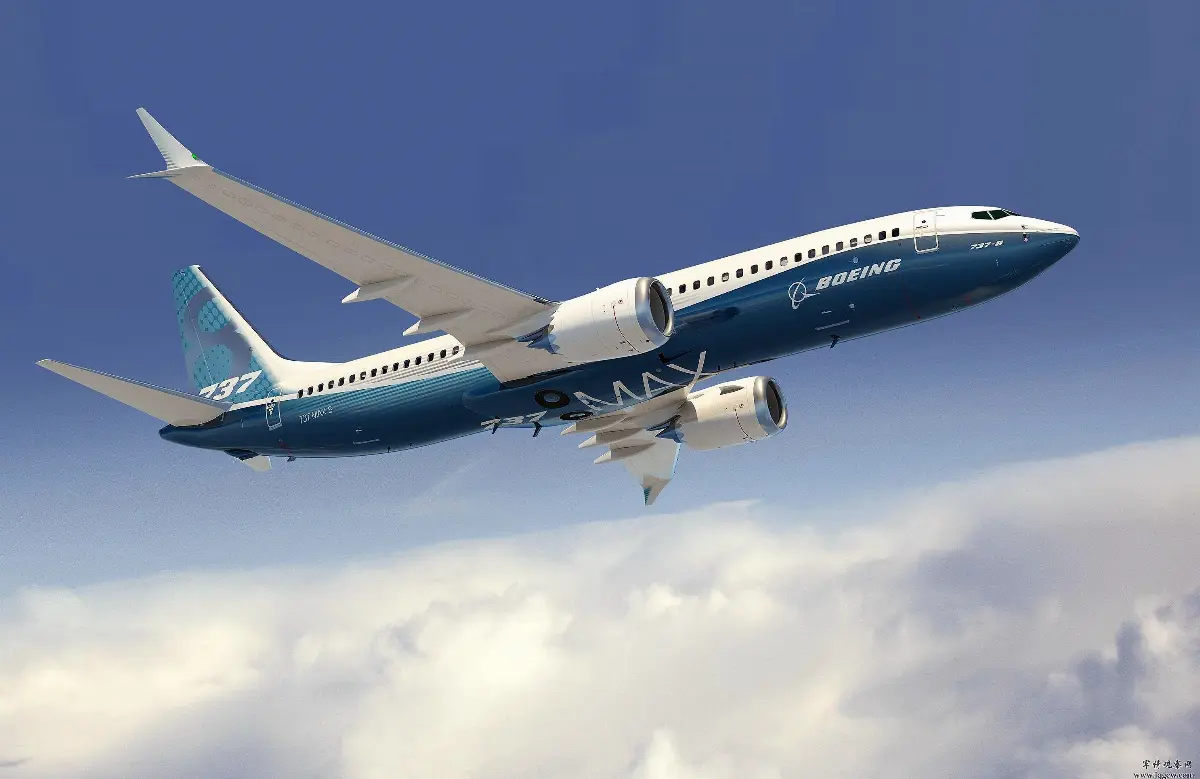

On the 737 program, during the quarter a supplier non-conformance was identified on the aft pressure bulkhead section of certain 737 airplanes. This is not an immediate safety of flight issue and the in-service fleet can continue operating safely. Near-term deliveries and production will be impacted as the program performs necessary inspections and rework, and the company now expects to deliver 375-400 airplanes this year. On production, suppliers are continuing with planned rate increases, and the company expects to complete the final assembly transition to 38 per month by year-end, with plans to increase to 50 per month in the 2025/2026 timeframe. The estimated cost associated with performing the rework is immaterial and included in third quarter results.

The 787 program is now transitioning production to five per month and plans to increase to 10 per month in the 2025/2026 timeframe. The program still expects to deliver 70-80 airplanes this year.

During the quarter, Commercial Airplanes booked 398 net orders, including 150 B-737 MAX 10 airplanes for Ryanair, 50 B-787 airplanes for United Airlines, and 39 B-787 units for Saudi Arabian Airlines. Commercial Airplanes delivered 105 aircraft during the quarter and backlog included over 5,100 planes valued at $392 billion.

Defense, Space & Security

Third quarter revenue was $5.5 billion. Third quarter operating margin was (16.9) percent, due to a $482 million loss on the VC-25B program driven by higher estimated manufacturing cost related to engineering changes and labor instability, as well as resolution of supplier negotiations. Results were also impacted by $315 million of losses on a satellite contract due to estimated customer considerations and increased costs to enhance the constellation and meet lifecycle commitments.

During the quarter, Defense, Space & Security delivered the first T-7A Red Hawk to the US Air Force and captured an award from the US Army for 21 AH-64E Apache helicopters. Backlog at Defense, Space & Security was $58 billion, of which 29 percent represents orders from customers outside the US.

Global Services

Third quarter revenue of $4.8 billion and operating margin of 16.3 percent reflect higher commercial volume and mix.

During the quarter, Global Services delivered the 150th 737/800 Boeing Converted Freighter, received an order from the US Navy for P-8 trainer upgrades and signed a digital maintenance solution agreement with Philippine Airlines for Airplane Health Management.

AVIONEWS - World Aeronautical Press Agency